|

Posted originally on 26 May 2021 by Juan Ocampo (Department of Business Administration). This post is part of a blog post series on AI and sustainability. Artificial Intelligence in the field of Financial Inclusion

As we have been discussing along this series of posts on AI and Sustainable development algorithms are increasingly becoming recognised as an important element in our society and this is not different in the financial world. What interests me and my research is financial inclusion, for which AI has been focused in enhancing both communication and risk assessment. For this introductory post, I will mention the general characteristics of these applications and later briefly explain how the ML for chatbots work. In future posts I will cover the other applications so keep in the loop! But let’s start by summarising the three main use cases for financial inclusion: Risk measurement; Fraud Detections, and Customer service. Usually a bank will offer you a loan based on your financial history, but what happens with people that have been left out of the financial system? How do they create a financial record if they are not even allowed to start one in the first place? This is a challenge, both for the lenders (usually banks) and for the people that are trying to get a loan. To solve this challenge, AI is being used to assess people’s creditworthiness by using alternative data, which is basically the use of information beyond conventional credit information as your payment history or banking behaviours. Alternative data can consider information coming from your transaction in e-platforms (e.g. Amazon), your emails, or even your movements (i.e. GPS location information)[1],[2]. All this information, or data points, are usually stored in your phone, mobile apps, and internet behaviour, for which you give consent to use when accepting the terms and conditions of the services. Scary as it sounds, the idea is that based on these data points companies create credit-scoring models that evaluate your potential payment behaviour and suggest the approval and loan amount. A second use of AI is to automate fraud detections which is related to a term known as Know-Your-Customer (KYC). In broad terms, what these applications try to do is to avoid money laundry activities or identity thefts. Through this application the financial institutions try to secure that the information that is given when, for example, opening a bank account is true[3] for example by checking on different databases that store personal information or analysing your social media behaviour in an attempt to confirm your “trustworthiness” for future business transactions[4]. AI as financial advisor A third way in which AI is being used as a financial inclusion tool is to handle customers. Chatbots can enhance customer support, provide financial advice, or even suggest the user financial products they could acquire based on their financial actions. But how are chatbots relevant for financial inclusion? Well, I have been struggling with that question and even though there are many products related to handling customer calls and helping them to “self-serve”[5], the impact on people is rather functional in the sense that they can be served faster and cheaper (for the company at least), however, as you might have experienced, chatbots do not always offer the best experience (yet). Still, it is questionable the effect on improving people’s lives and solving societal problems. But we need to propose if we want to reclaim technology for the good, and in this post I will mention some opportunities for using AI for an equal and resilient economy. But before I go into this and following our initial post on more transparent and ethical AI[6], I think it is important to go ‘under the hood’ of chatbots and try to make this more transparent and accessible. The following section is a high overview of how the algorithms in chatbots work, however it serves the purpose of demystifying algorithms and help us think in how to make these algorithms work for the people. Introducing the chatbot In this post I will explain customer service chatbots. As for many industries, communicating with customers is key when providing customers a good experience and chatbots are (sometimes) good and cheap solutions for handling customers. As in many machine learning applications, these chatbots are based on great amounts of text databases but in this case they are built from dialogues between people. To make a chatbot application, the first step is to prepare the data, which basically means to separate sentences (or words) and later link these sentences in a way that a meaning can be ascribed. Most times, this is a table with a column that will be a question or context and a column for the answer[7]. Then we need to train the machine learning so it accomplishes the task, which in the case of chatbot could either be to respond in a ‘new’ way (i.e. generative) or based on previous answers (i.e. selective)[8]. If it is generative, machine learning will create a response that is not already defined in your database, so it is basically (trying) to be intelligent. In the second case, the machine will identify the meaning of the question and look for the answer that better suits it. In both cases, the ML use a process called sequence2sequence[9],[10],[11]. This process (developed in Google) iterates over potential answers (i.e. decoder) based on the previous inputs (i.e. encoders) and later selects the answer that offers the least loss in a utility function of the algorithm. For the sake of the explanation I will build on two examples from our daily life, so bear with me in this one. Imagine you are playing with your dog (in this case the algorithm). You have trained him before and he knows that if he makes you happy he will get a treat. The dog has been trained with a set of predefined instruction (i.e. encoder) in which a certain order means a specific response. So, you say sit, and based on his previous training he decides to sit (i.e. decoder) and gets a treat! This is an example of a selective case in which the algorithm will give a response based on predefined commands. Now imagine you are babysitting your beautiful niece, she is learning to talk so she makes sounds to communicate with you. This is not the first time you have been with her so you have been keeping a list of certain sounds she makes when you are doing certain actions. In this case, you are the algorithm and the list with sounds and actions is the training dataset. Today, with a smile in her face she says “bo” “gal”! You look at your list and learn that the last time she said “bo” you were eating peas and carrots and for “gal” you were eating smashed apples. Based on that information you decide to give her smashed carrots, she starts to cry! This is a fail case of a generative response based on previous data. It might be she wanted smashed peas or complete apples, so as you see generative algorithms are more complex since the responses are not pre-set and more context is needed. Even thought some would agree that keeping a baby happy is a benefit for humanity, is not the type of purpose we want to discuss. Chatbots with a purpose Far beyond rigorous, the purpose of the previous explanation was to demystify AI. The more people understand that AI are algorithms that are developed by human beings with errors, biases, and interests, the quicker it will be for us to reclaim power over them. I want to stress the importance on the dataset that is informing a chatbot. These robots need to be trained by people with an interest in the wellbeing of the user and not only in the profit of the company that is ‘hiring’ the chatbot. This said, I believe that a meaningful and constructive application of chatbots for financial inclusion lays in basic financial education. Chatbots can be programmed as financial literacy tools in which people can ask questions and learn skills relevant for financial inclusion; for example, financial terminology or basic product education. Imagine an application in which uneducated users could ask a chatbot questions on the legality of products they are being offered or decision making support on questions that they don’t feel capable to deal with like interest rate calculation, conditions, or risk involved in loans. In other words, let’s make chatbots trustworthy financial advisors! There are three main benefits of this type of financial advisors that come to my mind:

By the way, if you are interested in AI and the impacts it will have in our society have a look a this discussion panel I moderated on June 2021. AI and the Future of Work[12]. [1] See for more information on alternative data: https://www.gpfi.org/sites/gpfi/files/documents/Use_of_Alternative_Data_to_Enhance_Credit_Reporting_to_Enable_Access_to_Digital_Financial_Services_ICCR.pdf [2] For more info on credit scoring: https://pubdocs.worldbank.org/en/935891585869698451/CREDIT-SCORING-APPROACHES-GUIDELINES-FINAL-WEB.pdf [3] For more about AI and Financial services. https://www.ifc.org/wps/wcm/connect/448601b9-e2bc-4569-8d48-6527c29165e8/EMCompass-Note-85-AI-Innovation-in-Financial-Services.pdf?MOD=AJPERES&CVID=nfuDUlG [4] Nir Kshetri (2021) The Role of Artificial Intelligence in Promoting Financial Inclusion in Developing Countries, Journal of Global Information Technology Management, 24:1, 1-6, DOI: 10.1080/1097198X.2021.1871273 [5] Some examples: https://kasisto.com/; https://www.viabcp.com/blog-bcp/arturito-bcp ; https://www.accion.org/chatbots-for-financial-inclusion [6]Initial post of the series: https://agenda2030.blogg.lu.se/an-introduction-to-ethical-ai/ [7] Vinyals and Le (2015) A Neural Conversational Model. https://arxiv.org/pdf/1506.05869.pdf [8] https://blog.statsbot.co/chatbots-machine-learning-e83698b1a91e [9] More on sequence 2sequence: Sutskever, Vinyals and Le (2014) Sequence to Sequence Learning with Neural Networks. https://arxiv.org/pdf/1409.3215.pdf [10] More on sequence 2sequence: Vinyals and Le (2015) A Neural Conversational Model. https://arxiv.org/pdf/1506.05869.pdf [11] More on sequence 2sequence: https://blog.keras.io/a-ten-minute-introduction-to-sequence-to-sequence-learning-in-keras.html [12]More info on the event: https://entrepreneur.lu.se/kalendarium/future-of-work-challenges-and-opportunities-for-ai [13] Register to the event: https://docs.google.com/forms/d/e/1FAIpQLSd_nbiy1_QKTvltKTBu8fVo88wPGviJ1K_CrhIGnVTT98ISfA/viewform?usp=send_form

1 Comment

Posted on 10 February 2021 by Jesica Murcia López (Centre for Environmental and Climate Science) and Juan Ocampo (Department of Business Administration).

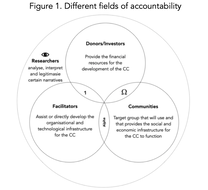

This post was originally published in Agenda2030 Graduate School blogg “The world in which you were born is just one model of reality. Other cultures are not failed attempts at being you; they are unique manifestations of the human spirit.” – Wade Davis Sharing a common background, from Colombia, where social, environmental and economical challenges contrast with the beauty of its mountains, rivers, biodiversity, and culture. Complexity is embedded in the way we, Jesica and Juan, approach our research. Therefore, it is not surprising for us to recognise the differences and nuances that emerge from the systems we study. To navigate and resolve the interplay of sustainable-related problems in real cases, being political displays of power, economic transfers of ownership, or environmental transformations, complex thinking becomes an appropriate state of mind. Our collaboration was triggered by a popular-science documentary called Tribuga – expediciontribuga.com inspired by books of Wade Davies (see Magdalena or The River) and resulted in conversations and discussions about ways to study complex problems. There are different ways of studying complex systems. An example is sustainometrics. This technique aims to describe and represent the interconnectedness of five domains of human activity, namely environmental, socio-cultural, technological, economics, and public policy, and their interaction with regard to achieving the goals of sustainability[1]. As sustianometrics, there are plenty of different methods that help us to engage with problems as the ones presented in sustainable development, many of these involved modelling. Modelling – the production and revision of models – has been seen as the essence of the dynamic and non-linear processes involved in the development of scientific knowledge[2]. And this post is about models! Models are not one-to-one reflections of reality, however, if constructed with rigour they have the potential to be ‘illuminating’ abstractions[3], and can be used to explain social, ecological and economic systems. Today we require methods that offer us new perspectives and understandings to tackle the complex problems that hinders sustainable development. Our common interest was to start a first glimpse of the technicalities behind the use of such models, and how other researchers and ourselves are attempting to highlight the benefits and challenges of these approaches in the contribution to scientific debates. In this line of thought, this post introduces Agent-Based modeling (ABM) and System Dynamics (SD), both of them increasingly being used in environmental, social and economic sciences. Using Agent-based Models for money engineering In his research Juan studies the engineering of Money. Specifically, he studies Complementary Currencies (CC) which are the voluntary agreement within a community to: (i) use a standardised unit of account to value their contributions, these being cleaning the streets, taking care of the elderly, or their produced good and services; (ii) accept these units as a mode of payment form other members; and (iii) use this units as a medium of exchange inside the community. In his research he has found it is not unusual to find situations in which stakeholders are not aware of basic socio-technical components of money until problems emerge. Money is a complex topic, it embedded social, ideological and technical components that if they are not openly discussed they might jeopardize the relations and hinder the success of the CC. Therefore, it is important for interested stakeholders to assure there is a proper description on the socio-cultural and spatial context of target communities and a thoughtful analysis on the economic theories, their mathematical formulations, and their influence in the communities’ socio-economic relations. Agent-Based Models (ABM) are a type of computer-based technique that can represent the behaviours and interactions of human and non-human actors (e.g. animals, institutions) and allow rich and dynamic representations of individuals in a particular ecosystem, and during a specific range of time. In other words, ABM “support a metaphorical representation of complexity by programming actions, decisions and mechanisms in explicit form”[4]. Increasingly, ABM have been developed to assist the management, governance, and research of different complex scenarios. For example, the OECD has used this computational tool to analyse systemic financial risks[5], or economic and environmental systems[6]. Juan’s project aims to use ABM through a practice called participatory modeling. This way of modeling is a learning process for action that invite the stakeholders to share their implicit and explicit knowledge and create shared models that represent the complex problems[7] they deal with. In other words, ABM serves as a way for designers of Complementary Currencies to be open about their interests, be aware of each other’sassumptions, and integrate their needs. It would be impossible to model it all, however through a compromise it is possible to program key variables and decision-making behaviours into explicit computational models. By programming different monetary configurations and modelling different human-behaviours it will be possible to simulate different scenarios and reflect on possible challenges and opportunities that Complementary Currencies might offer in search for an equal and inclusive monetary system. Systems thinking and system dynamic modelling for sustainometrics Systems thinking is a way to understand the complexity of core dimensions of sustainability, economic, social and ecological systems[8]. In our current times, sustainable development problems can be evaluated with network analysis. Any complex system is a set of interacting variables that behave according to governing mechanisms[9] and as the complexity of sustainability-related problems increases, it is more and more difficult to understand the related models. However, according to Costanza et al[10] “(m)odels are analogous to maps… they have many possible purposes and uses, and no one map, or model is right for the entire range of uses”. Additionally, these models are only possible with the current advances in information technology and information theory. In her research Jesica uses such models of land use change as primary “diagrams” for analysing the causes and consequences of land use changes. The use of system dynamics modeling methodology will serve to compare causal loop diagrams of forest cover dynamics in the Northwest Amazon region of Colombia generated by key actors working to tackle deforestation as a result of extensive cattle ranching activities in the area. Complementary, using supportive geographical information system (GIS) methods and software to assess the impacts of land use change on ecosystems to support land use planning and policy makers, represent a way to translate the complexity involved in these kinds of accurate system dynamic (SD) models. System Dynamics covers a set of qualitative tools for the analysis of dynamic processes, e.g. Causal Loop Diagrams (CLD) and Stock and Flow Diagrams (SFD) simulation and optimisation software. Since the introduction of systems thinking in terms of sustainability attained by Forrester in 1971 on his book World Dynamics[11], and then Meadows and collaborators (1972) work[12], a well-known effort concerning the topic, “The Limits to Growth”, focused on the simulation of the issues of sustainability worldwide with a more deep conceptual understanding of the modelled socio-economic and environmental systems as well. Her study looks at the interactions between pristine forests ecosystems, livestock, and the deforestation rates in protected areas, located in the northern part of the Chiribiquete National Park – whc.unesco.org. The study focuses on modelling forest land degradation in the Savannas of Yarí from 2016-2020 and simulates future scenarios up to 2030 using system dynamics modelling. In similar studies, in the Brazilian Amazon[13] the use of these models provided a first approximation of the loss of ecosystem services that is attributable to deforestation, considering that the patterns and processes of land use—and the economic incentives that drive them—continue unabated. In the Philippines[14] researchers used group model-building exercises, involving both researchers and community members, and they found that systemic understanding of deforestation can generate more robust reforestation initiatives. Conclusion The urgent need to understand human activity, namely environmental, socio-cultural, technological, economics, and public policy and their related sustainability-related problems as mentioned before, requires simultaneous integration of economic, social and ecological knowledge. In this way we can manage to understand sustainable development not in an incompatible way but as human evolution within a constantly changing natural world. Hence, the modelling of sustainability-related complex systems can support us to interpret holistic approaches without leaving key variables or agents of change outside the box. Consequently, aiming to better decisions making towards concrete actions on planetary goals for 2030, there is an urgent need to comprehend the interplay of the pillars for sustainability, through modelling of real-world problems. However, models are tools constructed by people and we have to be aware of this when we use them or read about their results. In both cases using ABM or SD is not only about the quantitative results and analysis that can be simulated in regards to inequality or sustainable development. If developed in a participatory way ABM and SD become an object to trigger dialogue amongst stakeholders and serve as a tool for learning more about each other’s way of thinking. This way the importance of insights into points of leverage for any system can help us get solutions into action. [1] Steward, W. C., & Kuska, S. 2011. Sustainometrics: Measuring sustainability—design, planning, and public administration for sustainable living (p. 144). Norcross, GA: Greenway Communications. [2] Justi, R. S. & John K. Gilbert, J. K. 2002. Modelling, teachers’ views on the nature of modelling, and implications for the education of modellers, International. Journal of Science Education, 24:4, 369-387. DOI: 10.1080/09500690110110142 [3] Fukuyama, F., Epstein, J. M., & Axtell, R. (1997). Growing Artificial Societies: Social Science from the Bottom Up. Foreign Affairs. https://doi.org/10.2307/20048043 [4] Zellner, M. L. (2008). Embracing complexity and uncertainty: The potential of agent-based modeling for environmental planning and policy. Planning Theory and Practice. https://doi.org/10.1080/14649350802481470 pg.443 [5] OECD (2012), “Social unrest and agent based models”, in Systemic Financial Risk, OECD Publishing, Paris, https://doi.org/10.1787/9789264167711-11-en. [6] https://www.oecd-ilibrary.org/agriculture-and-food/economic-and-environmental-sustainability-performance-of-environmental-policies-in-agriculture_3d459f91-en [7] Voinov, A., Jenni, K., Gray, S., Kolagani, N., Glynn, P. D., Bommel, P., Prell, C., Zellner, M., Paolisso, M., Jordan, R., Sterling, E., Schmitt Olabisi, L., Giabbanelli, P. J., Sun, Z., Le Page, C., Elsawah, S., BenDor, T. K., Hubacek, K., Laursen, B. K., … Smajgl, A. (2018). Tools and methods in participatory modeling: Selecting the right tool for the job. Environmental Modelling and Software. https://doi.org/10.1016/j.envsoft.2018.08.028 [8] Holling, C., S. 2001. Understanding the complexity of economic, ecological, and social systems. Ecosystems, 4 (5), pp. 390-405. https://doi.org/10.1007/s10021-001-0101-5 [9] Walker, B & Salt, D. 2006. Resilience Thinking: Sustaining Ecosystems and People in a Changing World. (first ed.), Island Press, Washington. Consulted online [Accessed on 29 January 2021: https://books.google.se/books?hl=en&lr=&id=NFqFbXYbjLEC&oi=fnd&pg=PR1&ots=6pIYWDX_J9&sig=xyytGaz3hBRJ_gfrMaItSdAfpow&redir_esc=y#v=onepage&q&f=false] [10] Costanza, R., Wainger, L., Folke, C., and Mäler, K.-G. 1993. Modelling complex ecological economic systems, BioScience, 43(8), 545–555. https://doi.org/10.2307/1311949 [11] Forrester, J.W. 1971. World Dynamics, vol. 59, Wright-Allen Press, Cambridge. [12] Meadows, D.H., Meadows, D.L. and J. Randers, W.W. 1972. The Limits to Growth: A Report of the Club of Rome’s Project on the Predicament of Mankind. Universe Books. [13] Portela, R and Rademacher, I. 2001. A dynamic model of patterns of deforestation and their effect on the ability of the Brazilian Amazonia to provide ecosystem services. Ecological Modelling (143): 115–146. DOI: 10.1016/S0304-3800(01)00359-3 [14] Olabisi, L. S. 2010. System Dynamics of Forest Cover in the Developing World: Researcher Versus Community Perspectives. Sustainability (2): 1523-1535. doi:10.3390/su2061523  The sustainable development agenda has a special focus on people in vulnerable conditions. Adger and Winkels[1] argue that in order for development to be sustainable it is important to address the underlying components in vulnerable societies. Vulnerability is a complex concept that embeds different dimensions, some of them including aspects such as social relations, capabilities, assets, and social exclusion[2]. In consequence, it is worth analyzing the Sustainable Development Goals (SDG), from a vulnerability perspective. Using SDG wrapping as a point of departure, it is of interest in this document to reflect on some of the SDG indicators, specifically those with a focus on (digital) financial systems, which include banking, and credit availability (i.e Target 8.10). Financial systems support communities in (re)producing, distributing and accessing goods and services. Therefore, Target 8.10 could be interpreted as an attempt to stimulate the local markets through financial services. This interpretation of the underlying objective of the target, allows for exploring, or perhaps forking, alternatives that support the economic system and can be better held accountable for how they address vulnerable communities. An example of a financially inclusive solution coming from the business sector is micro-credits. Through this, financial service banks offer poor people access to cash liquidity but might also lock people in debt loops. From a vulnerability and resilience perspective, it is worth questioning if giving people access to credits is really building resilience capabilities or if these businesses are perpetuating vulnerability. Are the current targets of financial inclusion just a way of wrapping (framing) unsustainable practices into more "marketable” ones? An alternative coming from the grassroots is Complementary Currencies (CC), which are social technologies that create complementary monetary systems and aim to have economic and social benefits in the communities. CC can be designed for different purposes, for example to tackle social exclusion and unemployment, localize economies, and build social capital and civic commitment[3]. Today, several organizations are introducing digital CC in vulnerable communities, thus making them an interesting alternative for sustainable development. Surprisingly, they won’t necessarily have an impact on achieving the SDGs since this financial instrument won’t increase the number of ATMs in a region, or raise the amount of bank accounts in a community, which are the basic indicators for the financial inclusion component in the SDGs. CC leverages the strength of the local social, economic, and political infrastructures, therefore, to implement this social technology, it is important to develop the capabilities of the target communities. This process of implementation, financial, self-organization and social capabilities being developed, allows us to envision a potential increase in the community’s adaptive capacity, and hopefully a decrease in the community’s vulnerability. It is out of the scope of this document to describe in detail how these CC are being implemented, however, in line with the objective of this document, some reflections about how actors account for their implementation process might be in place. The development of CC is a complex endeavor that requires the interaction of different collective actors. Figure 1 presents four possible actors that interact in the development of the CC for development. These are: communities, donors/impact investors, facilitators, and observers (i.e Civil Society, NGO, Academia). Based on Fligstein and MacAdam[4] (2011), it is possible to argue that these collective actors, “interact with knowledge of one another under a set of common understandings about the purposes of the field, the relationships in the field (including who has power and why), and the field’s rules”. Actors are embedded in complex webs of fields[5] thus, are accountable to different stakeholders[6]. To construct these accountability frames, donors, facilitators, communities and observers make use of different frame constructs in the micro, meso, and macro level[7]. In this framing construction, accounting becomes an interpretative art[8] with a major role in shaping reality in order to create and maintain stable social worlds[9]. Accountancy becomes a construction of narratives in which hard numbers and soft language come to interplay. Digital currencies open the opportunity to represent performance both through the use of numbers, measures and statistics of impact, and through textualizations and contextualization of these numbers[10]. For example, facilitators frame strategic actions by highlighting the number of people that are being supported through the CC and developing emotional stories about why their solution is relevant to the world. Donors can communicate the number of people that are now eating “warm meals" thanks to their funds, attracting donors or impact investors. In one of the sessions held by the facilitators to train the community in implementing a CC, a community member claimed, “we will spend, spend, spend”, as an act of commitment to the project and thus increasing the number of local transactions to later be seen in the data. Finally, we the Observers, with our inquiry lenses analyze, reflect, discuss, make sense of these numbers, pictures, and texts. Through our knowledgeable accounts, we aim to inform the world about what is happening out there in reality. The question that motivated this document asked, “how does the SDG increase and/or shape accountability in the relevant field”? Well, they don’t. The accounts that the different actors develop, are constructing, redefining and contesting what the SDG are. The different CC actors transform (or wrap perhaps) the meaning of sustainability through their actions and later shape reality through their framing accounts. Realities, that hopefully, address the underlying components of vulnerability. [1] W. Neil Adger & Alexandra Winkels, 2014. "Vulnerability, poverty and sustaining well- being," Chapters, in: Giles Atkinson & Simon Dietz & Eric Neumayer & Matthew Agarwala (ed.), Handbook of Sustainable Development, chapter 13, pages 206-216, Edward Elgar Publishing. [2] Adger, W. N. (2006). Vulnerability. Global Environmental Change, 16(3), 268–281. doi: 10.1016/j.gloenvcha.2006.02.006; FAO, “AnalysIng Resilience for better targeting and action” (2016); Frankenberger, T., Mueller M., Spangler T., and Alexander S. October 2013. Community Resilience: Conceptual Framework and Measurement Feed the Future Learning Agenda. Rockville, MD: Westat [3] Smith, A., Fressoli, M., & Thomas, H. (2014). Grassroots innovation movements: challenges and contributions. Journal of Cleaner Production, 114-124 [4] Fligstein, N., & MacAdam, D. (2012). A theory of fields. New York: Oxford University Press. [5] Ibid. [6] Lounsbury, M., M. Ventresca & Hirsch, P.M. 2003. Social movements, field frames and industry emergence: a cultural–political perspective on US recycling. Socio-economic Review, 1: 71–104 [7] Joep P. Cornelissen & Mirjam D. Werner (2014) Putting Framing in Perspective: A Review of Framing and Frame Analysis across the Management and Organizational Literature, The Academy of Management Annals, 8:1, 181-235, DOI: 10.1080/19416520.2014.875669 [8] Morgan, G. 1988. Accounting as reality construction: towards a new epistemology for accounting practice. Accounting, Organizations & Society, 13, 477-485. [9] Fligstein, N., & MacAdam, D. (2012). A theory of fields. New York: Oxford University Press. [10] Sandell N. & Svensson, P (2014). The Language of Failure: The Use of Accounts in Financial Reports International Journal of Business Communication |

RSS Feed

RSS Feed